Why Buying DiCom?

Reasons to invest in the future ...

Real Time Proof of Reserves

Our unique approach of Real-Time Proof of Reserves enables users to verify at any moment that the GEM DiCom is backed by real assets at the needed amount.

It boosts transparency, market trust, and supports regulatory separation from stablecoins.

As an interested person or an investor, you have several avenues to proof the reserves, being it on-chain, off-chain or visually. This is our understanding of transparency.

And honestly, we do not know, why we are – as far as we know, the only market participant that offers this in such full detail and depth.

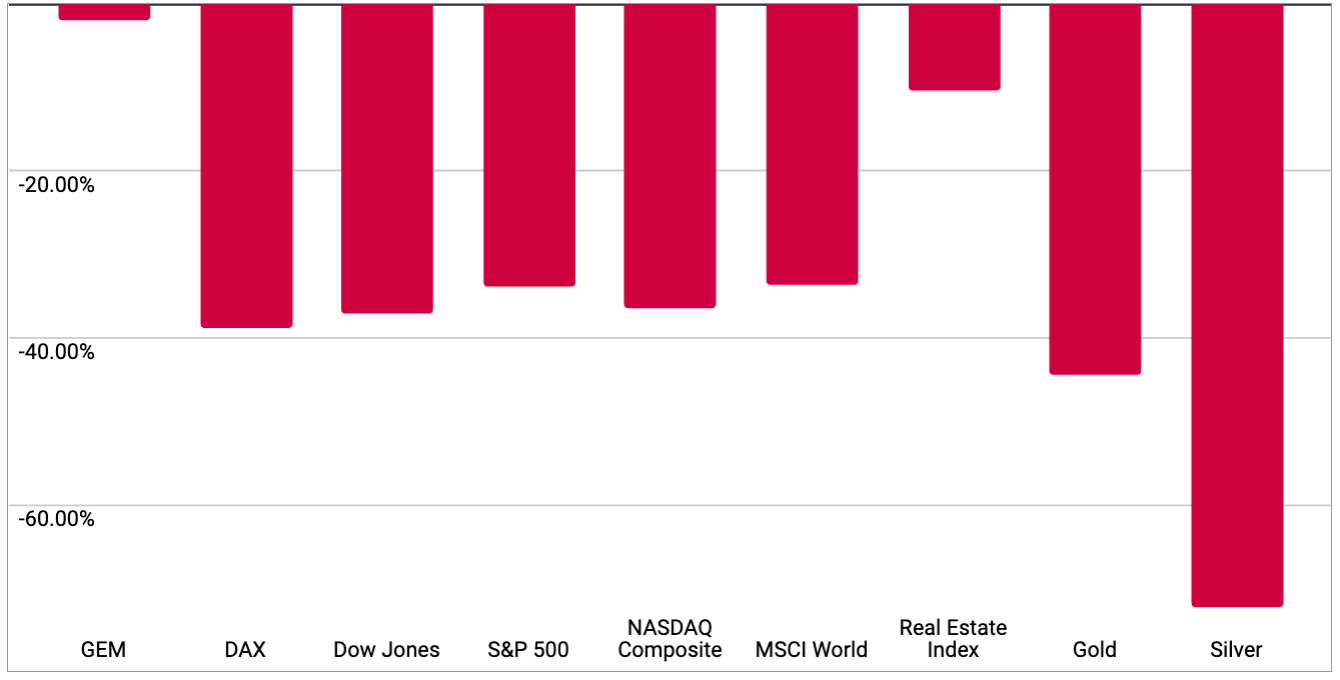

Minimal Drawdown

The Maximum Drawdown is a measure of the largest observed loss from a peak to a trough in the value of an investment before it recovers to a new peak. It is expressed as a percentage and helps assess downside risk over a specific period.

GEM’s Maximum Drawdown of 1.88% in the period 2011 to 2024 underlines the low downside volatility of GEM.

If you put the return into relation to the maximum drawdown, you get a ratio that helps assess how risky an investment is. This ratio is called Calmar Ratio. The higher the Calmar Ratio the better the risk-adjusted performance. This ratio shows how much return is achieved per unit of downside risk.

With a Calmar Ratio of 56.88 GEM is comfortably in the lead when it comes to risk assessment.

Because there’s such low volatility and such a small drawdown, it doesn’t matter at all when you invest in GEM. You don’t need market timing. The right time to invest is ALWAYS NOW and it’s ALWAYS OPTIMAL. Tell that to the guy who invested in gold in July 2011 and was still in the red in December 2015.

BUT: As always, the results of the past are not a guarantee for the same results in the future. The future development might be totally different. See also our Disclaimers.

Top Performance

Having a low Maximal Drawdown normally comes with less return. Interestingly not in this case.

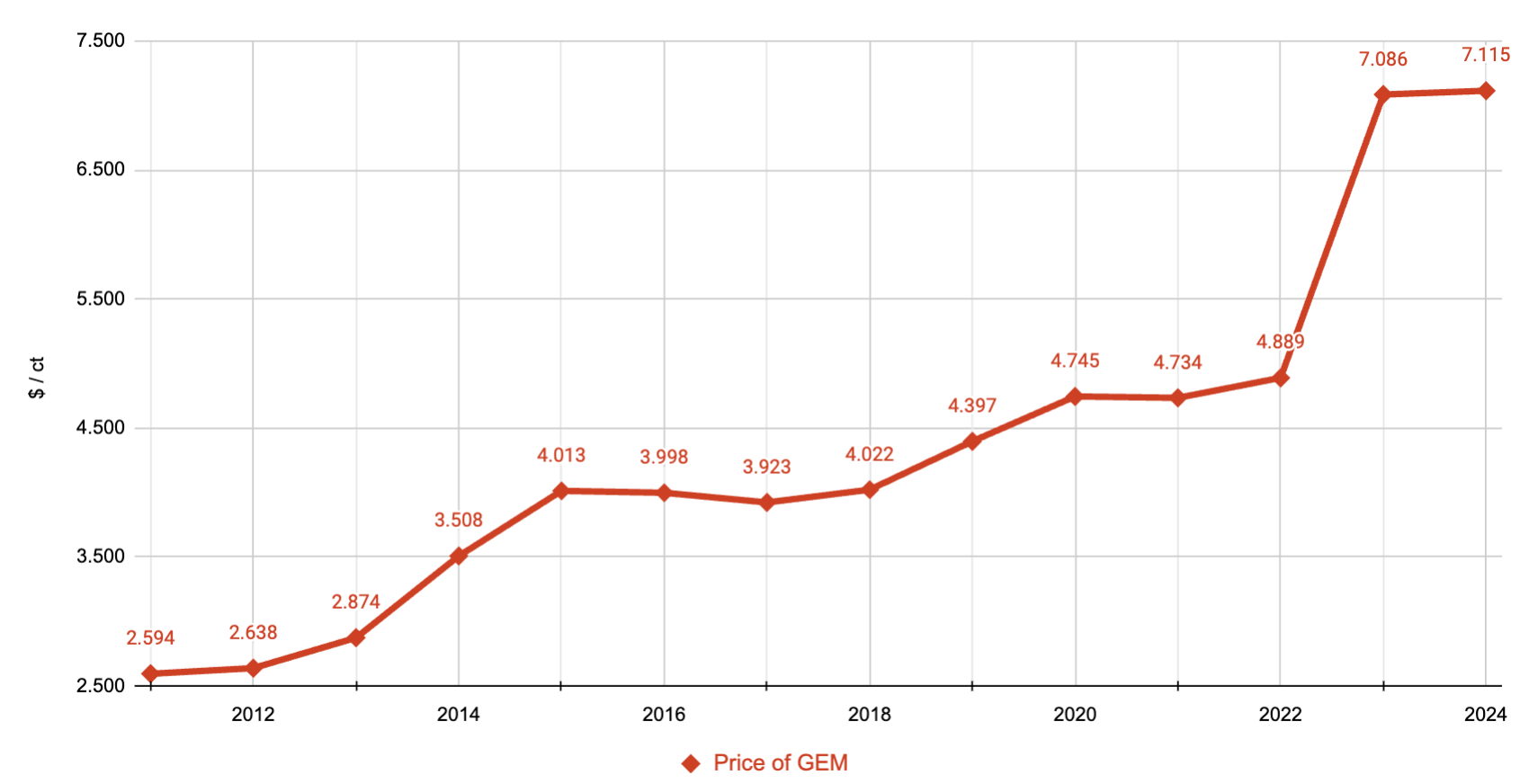

The index, meaning the portfolio of 12 investment-grade coloured gemstones that ultimately back GEM DiCom has increased from $2,594 per carat in 2011 to $7,115 per carat in 2024, which translates to an annual increase of some 12.5%. This index is the reference for GEM. Therefore, back tested, GEM's price increased from $2,594 in 2011 to $7,115.

BUT: As always, the results of the past are not a guarantee for the same results in the future. The future development might be totally different. See also our Disclaimers.

Democratized Access

Traditionally, gemstone investing has always been reserved for the noble [1] and wealthy.

A single investment-grade gemstone typically starts at $15,000, with most stones costing far more. This high entry barrier – combined with the need for expert knowledge, secure storage, and access to exclusive dealer networks – has made the gemstone market inaccessible to most people.

With GEM DiCom, that changes. Through Digitally Melting, GEMtrust allows anyone to invest in a well diversified portfolio of twelve high-quality, investment-grade colored gemstones [2] starting from as little as $1.

This means no less than that for the first time in history, the outstanding properties of gesmstones (stability and long-term value) are no longer limited to high-net-worth individuals or noble families.

We are opening up a whole new asset class – one that was historically closed off – and making it accessible to everyone.

_______

[1] “Gemstone” means “Edelstein” in German, with “edel” being the German word for “noble.” So in German, “gemstones” literally means “stones of the noble.”

[2] Due to this, the already low volatility and downside risk of gemstones is further reduced, which explains the low maximum drawdown of this selected portfolio .

Copyright © GEMtrust DAO - All Rights Reserved